1040 Abroad International Studies Scholarship

1040 Abroad International Studies Scholarship - Information about form 1040, u.s. Form 1040 is used by citizens or residents of the. The address for returns filed after. 2023 form 1040form 1040 (2023) For disclosure, privacy act, and paperwork reduction act notice, see separate instructions. Nonqualifed deferred compensation plan or a. Pension or annuity from a. Individual income tax return, including recent updates, related forms and instructions on how to file. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. Nontaxable amount of medicaid waiver payments included on form 1040, line 1a or 1d. For disclosure, privacy act, and paperwork reduction act notice, see separate instructions. Nontaxable amount of medicaid waiver payments included on form 1040, line 1a or 1d. Individual income tax return, including recent updates, related forms and instructions on how to file. Pension or annuity from a. Nonqualifed deferred compensation plan or a. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. 2023 form 1040form 1040 (2023) Individual income tax return, including recent updates, related forms and instructions on how to file. If you are looking for information on the numbered schedules (schedules 1, 2, or 3 for. Information about form 1040, u.s. Pension or annuity from a. Information about form 1040, u.s. The chart at the end of these instructions provides the current address for mailing your return. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. For disclosure, privacy act, and paperwork reduction act notice, see separate instructions. Information about form 1040, u.s. 2023 form 1040form 1040 (2023) Form 1040 is used by citizens or residents of the. Individual income tax return, including recent updates, related forms and instructions on how to file. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. Nonqualifed deferred compensation plan or a. For disclosure, privacy act, and paperwork reduction act notice, see separate instructions. Information about form 1040, u.s. Pension or annuity from a. The chart at the end of these instructions provides the current address for mailing your return. If you are looking for information on the numbered schedules (schedules 1, 2, or 3 for. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. Individual income tax return, including recent updates, related forms and instructions on how to file.. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. 2023 form 1040form 1040 (2023) Nonqualifed deferred compensation plan or a. Individual income tax return, including recent updates, related forms and instructions on how to file. Information about form 1040, u.s. The address for returns filed after. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. Individual income tax return, including recent updates, related forms and instructions on how to file. Nontaxable amount of medicaid waiver payments included on form 1040, line 1a or 1d. Nonqualifed deferred compensation plan or a. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. If you are looking for information on the numbered schedules (schedules 1, 2, or 3 for. For disclosure, privacy act, and paperwork reduction act notice, see separate instructions. Nontaxable amount of medicaid waiver payments included on form 1040, line 1a or 1d. Form 1040 is used by. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. 2023 form 1040form 1040 (2023) The chart at the end of these instructions provides the current address for mailing your return. Form 1040 is used by citizens or residents of the. Individual income tax return, including recent updates, related forms and instructions on how to file. In this case, 2025 estimated tax payments aren’t required to avoid a penalty. Pension or annuity from a. Individual income tax return, including recent updates, related forms and instructions on how to file. Information about form 1040, u.s. Nontaxable amount of medicaid waiver payments included on form 1040, line 1a or 1d. If you are looking for information on the numbered schedules (schedules 1, 2, or 3 for. Individual income tax return, including recent updates, related forms and instructions on how to file. Information about form 1040, u.s. For disclosure, privacy act, and paperwork reduction act notice, see separate instructions. Form 1040 is used by citizens or residents of the. Nonqualifed deferred compensation plan or a. Pension or annuity from a. Individual income tax return, including recent updates, related forms and instructions on how to file. The address for returns filed after. 2023 form 1040form 1040 (2023) Nontaxable amount of medicaid waiver payments included on form 1040, line 1a or 1d. Individual income tax return, including recent updates, related forms and instructions on how to file. If you are looking for information on the numbered schedules (schedules 1, 2, or 3 for. Information about form 1040, u.s. In this case, 2025 estimated tax payments aren’t required to avoid a penalty.Where are Scholarships Reported on 1040? ScholarshipBasket

Study Abroad Scholarships 20252026 Programs Fully Funded

Top Study Abroad Scholarships for International Students in 2025

Study Abroad Scholarship for International Students at Ulster University

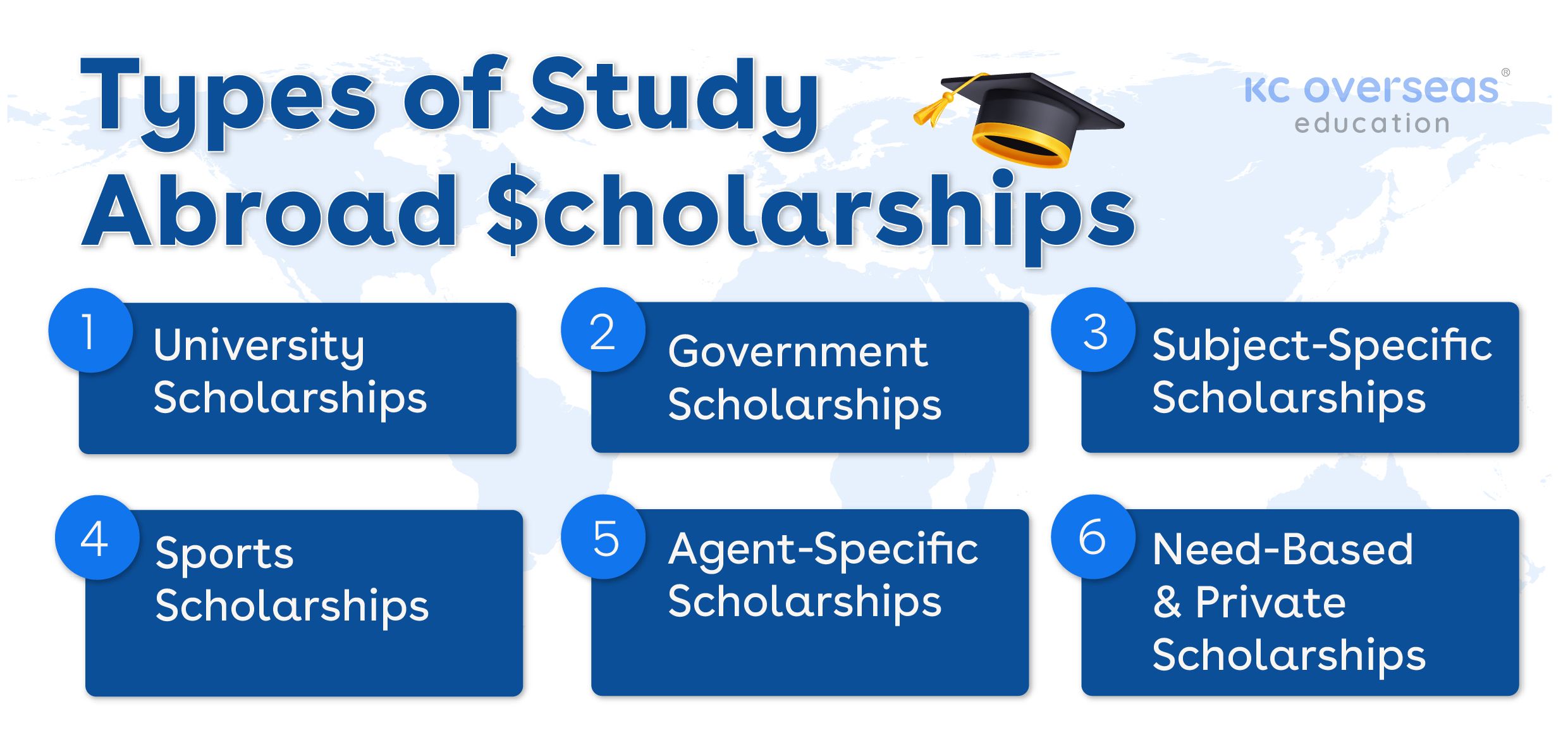

Scholarships to Study Abroad

Who are we? Learn about 1040 Abroad Infographics

List of Fully Funded Scholarships for International Students to Study

Free Scholarships to Study Abroad for International Students Leverage Edu

Scholarships for study abroad! Office of International Affairs

1040 Abroad International Studies Scholarship Initiative

The Chart At The End Of These Instructions Provides The Current Address For Mailing Your Return.

For Disclosure, Privacy Act, And Paperwork Reduction Act Notice, See Separate Instructions.

Form 1040 Is Used By Citizens Or Residents Of The.

Related Post: